Download the Article PDF Version

The UAE Corporate Tax Law (CTL) introduced in 2023 has established a new framework for taxation of businesses operating within the country, including the taxation of foreign source income (FSI). This article delves into the intricacies of foreign source income under the UAE Corporate Tax Law, outlining the key definitions, eligibility criteria, and tax implications for UAE residents and non-residents.

Understanding Foreign Source Income

Under the UAE Corporate Tax Law, Foreign Source Income refers to income earned by a UAE resident or non-resident from activities, operations, or assets located outside the UAE. While the UAE’s tax framework primarily focuses on domestically sourced income, foreign source income can also be subject to corporate tax under certain conditions.

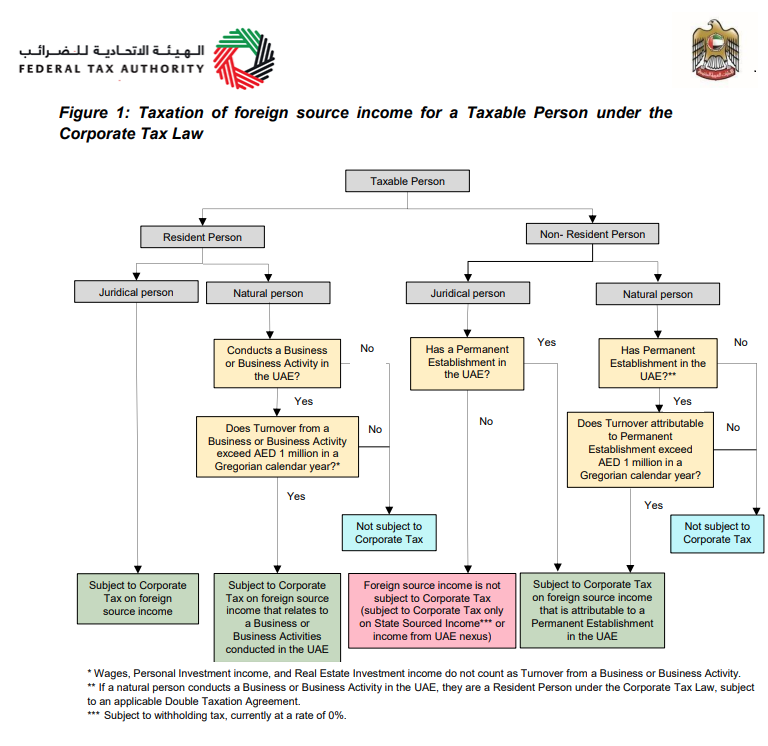

Determining Taxability of Foreign Source Income

The taxability of foreign source income depends on the legal status (juridical person or natural person) and residence status (Resident Person or Non-Resident Person) of the Taxable Person.

Juridical Person: Juridical Persons, such as companies incorporated in the UAE, are subject to Corporate Tax on their worldwide income, including both domestic and foreign source income. However, certain exemptions and reliefs, such as the Participation Exemption and the Foreign Permanent Establishment exemption, can mitigate or eliminate potential double taxation.

Natural Person: Natural Persons are subject to Corporate Tax on foreign source income only if it is related to their Business or Business Activity conducted in the UAE. Wages, Personal Investment income, and Real Estate Investment income are not subject to Corporate Tax, regardless of their source.

Taxation For Different Taxable Persons, Exemptions, and Reliefs

The UAE Corporate Tax Law applies a nuanced approach to the taxation of foreign source income based on the type of Taxable Person involved, including to prevent double taxation. This provides exemptions and reliefs for Foreign Source Income.

Resident Persons: Resident Persons, individuals or companies residing in the UAE, are subject to corporate tax on their worldwide income, including foreign source income. However, the CTL provides exemptions and reliefs to mitigate or prevent double taxation of foreign source income. These include:

-

-

Participation Exemption: This exemption applies to dividends, profit distributions, and capital gains derived from juridical non-resident persons where the effective tax rate in the foreign jurisdiction is at least 9%.

-

Foreign Permanent Establishment Exemption: This exemption allows a Resident Person to elect to exclude the income and associated expenses of a foreign PE from their UAE taxable income if the PE is subject to a minimum tax rate of 9% in the foreign jurisdiction.

-

Foreign Tax Credit: This credit allows a taxpayer to offset taxes paid in a foreign jurisdiction on foreign source income against their UAE corporate tax liability.

-